37+ pay off mortgage with 401k cares act

But this increase isnt automatic. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Stories From Stories From U Va Alumni Association University Of

Web If youre younger than 59½ youre ordinarily subject to a 10 percent early withdrawal penalty in addition to income tax if you remove money from an IRA 401k.

. You can now borrow up to 100000 or 100 of your balance and pay it back over. The CARES Act waives that for coronavirus-related withdrawals. Web 401k Loans.

However every borrower should consider all the angles carefully before. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Ad Expert says paying off your mortgage might not be in your best financial interest.

If you need to borrow money and would rather not deal with a bank the act doubles the amount you can borrow to 100000 or 100 of your vested. Web Provisions for loans or withdrawals from 401 k plans have been relaxed for 2020. Web The CARES Act waives the 10 penalty for early withdrawals from account holders of 401k and IRAs if they qualify as coronavirus distributions.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Usually you pay a 10 penalty on early 401k withdrawals which are also known as distributions. Web The CARES Act allows you to withdraw up to 100000 from your retirement account -- penalty-free -- until the end of 2020.

Web For many this might seem like a great way to pay off their mortgage now and reduce their debt load. Web The CARES Act provides that qualified individuals may treat as coronavirus-related distributions up to 100000 in distributions made from their eligible retirement. While youre generally subject to a 10 early withdrawal penalty.

Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time. Web The CARES Act has made it easier for workers suffering due to the Covid-19 pandemic to tap their 401 k plans and IRAs. Web You may also be able to take a penalty-free withdrawal for up to 100000 under the CARES Act.

An individual can now take a withdrawal of. For 2023 the l See more. Web Paying off a mortgage is one reason you might borrow from a 401 k.

If you took out a. If you qualify under. So far relatively few Americans have.

Web Under the CARES Act individuals eligible for coronavirus-related relief may be able to withdraw up to 100000 from IRAs or workplace retirement plans before. Against those advantages of paying off your mortgage are several downsidesmanThe greatest caveat to using 401 k funds to eliminate a mortgage balance is tContribution limits are in place that cap the total amount that can be saved in any giFor 2022 the 401 k annual contribution limit is 20500. Web The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401k withdrawals for those impacted by the.

Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before. Web The CARES Act 401 k withdrawal option allowed many Americans and business owners to access additional cash to take care of their needs. If you have a low mortgage balance and a substantial 401 k balance you might be able to.

Retirement Changes Due To The Cares Act

Whidbey Weekly May 3 2018 By Whidbeyweekly Com Issuu

8 20 Townelaker Webfinal By Aroundabout Local Media Inc Issuu

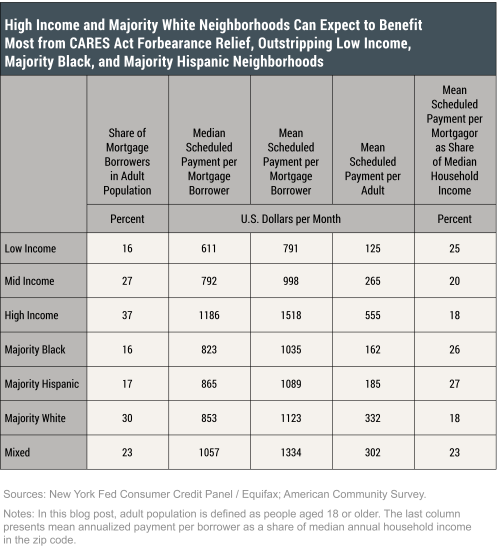

Debt Relief And The Cares Act Which Borrowers Benefit The Most Liberty Street Economics

2468 Process Innovation Enterprise Architecture Foundation For O

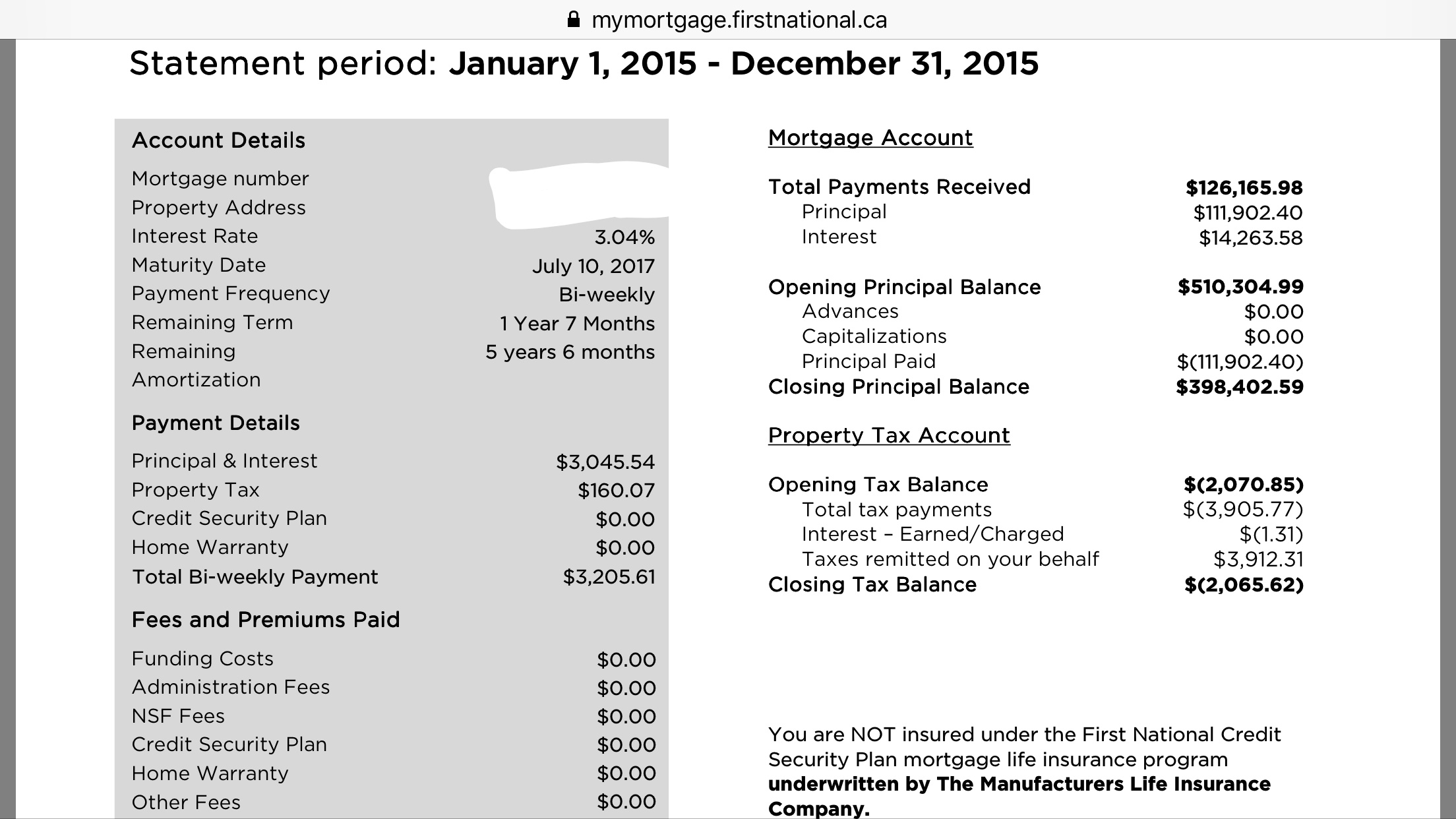

Should I Pay Off My Mortgage With My 401 K Lighthouse Financial Enterprises Inc

How Much Down Payment On A House Is Needed

Does Prepaying Your Mortgage Beat Contributing To Your 401 K

October 2016 Dc Beacon By The Beacon Newspapers Issuu

2468 Process Innovation Enterprise Architecture Foundation For O

How To Pay Off A Mortgage In 5 Years 99to1percent

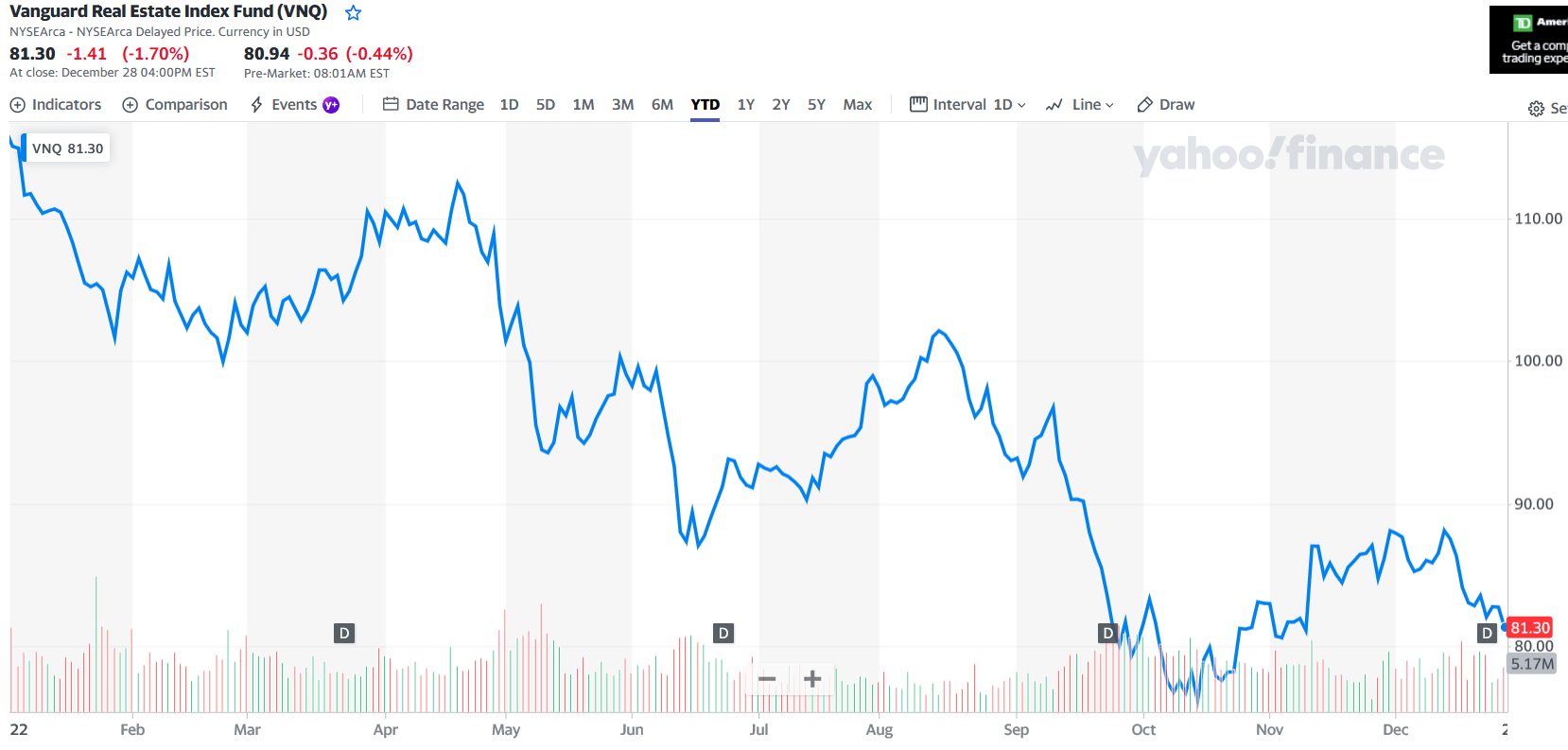

My Biggest Reit Losers In 2022 Seeking Alpha

Can I Use My 401 K To Pay Off My Mortgage

/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif)

401k 대출 Loan 이란 은퇴덕후 Eunduk

Personal Finance Apex Cpe

Can A Foreign Company In U S A Avoid Paying Taxes At All Quora

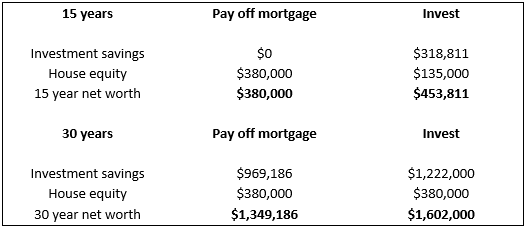

Deciding The Pay Down Mortgage Or Invest Debate Esi Money